tax avoidance vs tax evasion south africa

A tax shelter is one type of tax avoidance and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code.

Tax Avoidance Vs Tax Evasion Infographic Fincor

In this article I will explain what tax avoidance and tax evasion is with examples of each.

. Tax avoidance tax evasion tax heavens illicit financial flows and global tax governance are real buzzwords that have come to dominate current international political and financial domains. Diuga highlights the difference between evasion planning and avoidance. Businesses avoid taxes by taking all legitimate deductions and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the Internal Revenue Code or state tax codes.

Tax Avoidance is legal. Tax evasionThe failure to pay or a deliberate underpayment of taxes. While there is typically agreement over the meaning of tax evasion the other two categories are more contentious2 22.

Tax evasion means concealing income or information from tax authorities and its illegal. Businesses get into trouble with the IRS when they intentionally evade taxes. And 3 legitimate tax planning or tax mitigation.

There is not so much of a fine line between tax evasion. Underground economyMoney-making activities that people dont report to the government including both illegal and legal activities. 2 impermissible tax avoidance.

Tax avoidance and tax evasion are different ways in which a company or an individual can avoid paying SARS. Tax Evasion vs. Tax avoidance tax evasion tax heavens illicit financial flows and global tax governance are real buzzwords that have come to dominate current international political and financial domains.

Tax Avoidance vs Tax Evasion. Staff Writer 14 September 2021. In tax avoidance you structure your affairs to pay the least possible amount of tax due.

However this first part also shows that the impacts for South Africa are not only in terms of taxes and public revenues losses. While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to. By contrast tax evasion is the general term for efforts by individuals firms trusts and other entities to evade the payment of taxes by illegal means.

In tax evasion you hide or lie about your income and assets altogether. Africa Africas problem with tax avoidance. Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share September 14 2021 Steve Tillman 0 Comments There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth manager in Cape Town at.

Using unlawful methods to pay less or no tax. While tax evasion was generally regarded as an illegal and dishonest means to escape tax tax avoidance was viewed as a legitimate and continue reading Continue reading. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment.

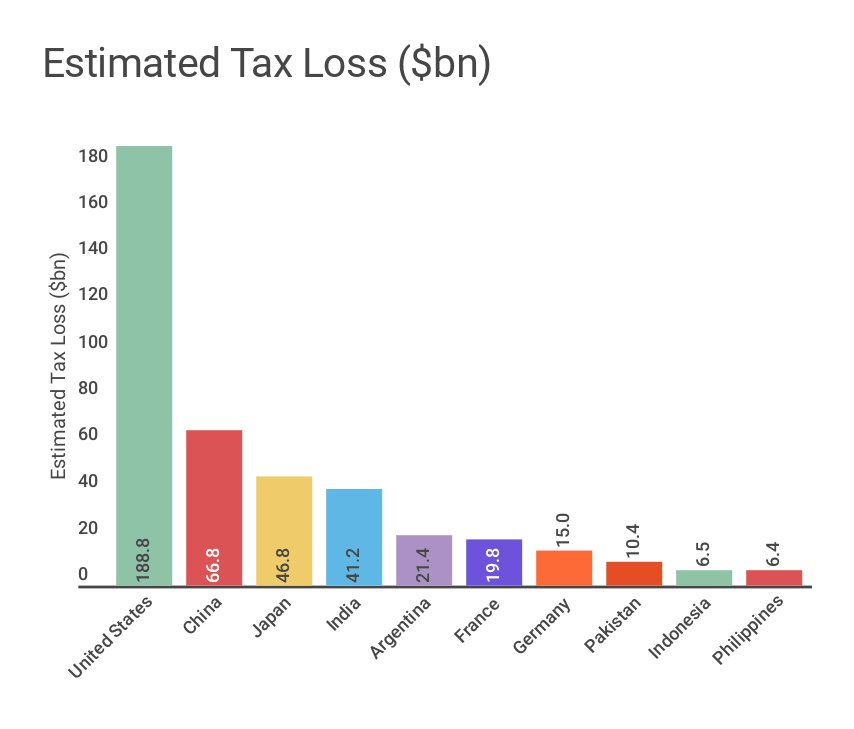

Every year African countries lose at least 50 billion in taxes more than the amount of foreign development aid. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations. While you get reduced taxes with tax avoidance tax evasion can result in.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax avoidance is the legal usage of the tax regime in a single territory to ones own advantage to reduce the amount of tax that is payable by means that are within the law. Is one of South Africas leading news and information websites.

Acts need not fit under the taxing rules. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts.

Tax Avoidance vs Tax Evasion in South Africa. Basically tax avoidance is legal while tax evasion is not. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax.

Tax Avoidance and Evasion in Africa. Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share. What is tax evasion.

Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share September 14 2021 Liam Viljoen 0 Comments There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth manager in Cape Town at. Illicit financial flows also mean lower wages and chronic shortages of local savings. December 8 2021 Academic Journals 0.

Discussions of tax avoidance often begin with an attempt to define and distinguish three broad concepts. Tax Evasion is illegal. What is the difference between tax avoidance and tax evasion.

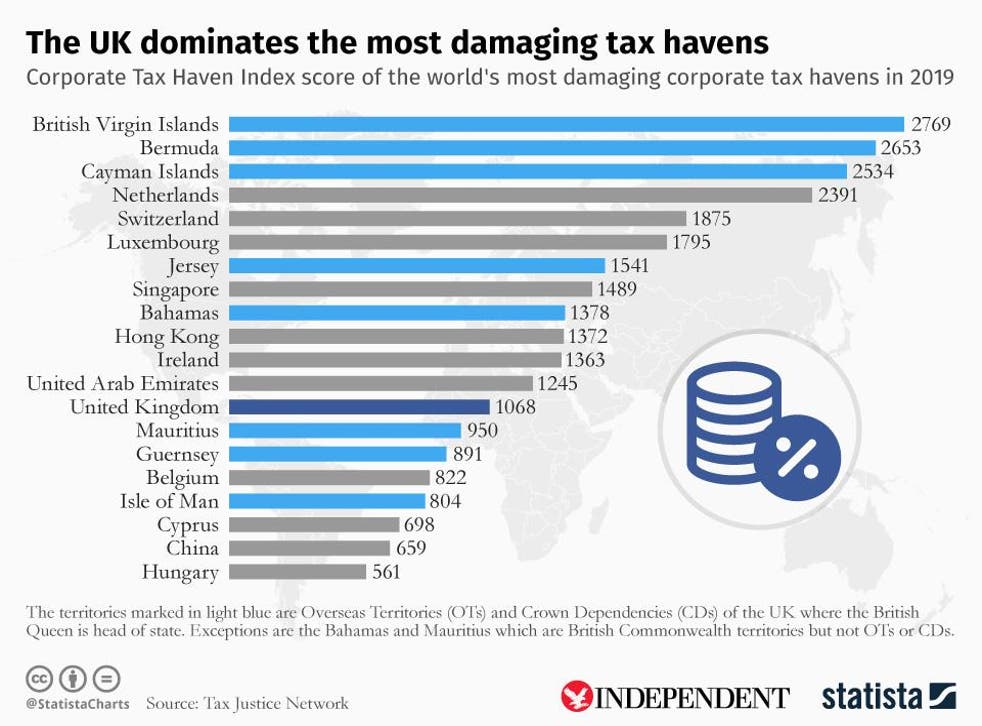

These two phenomena better captured by the concept of wage evasion than tax evasion concretely mean that South Africa. When considering evasion vs avoidance there are different tax reducing acts which will depend on the tax type at hand. Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven.

An example of tax avoidance would be importing unbuilt items that are charged at a reduced import taxes rate and thereafter getting them assembled in South Africa. 91621 1050 PM Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 511 Impermissible avoidance arrangement and updated GAAR 80 A-L Tax avoidance is typically described as the use of impermissible avoidance arrangements Overberg Asset Management noted that the 2006 amendments. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts.

Thus in the past it was generally accepted that there was a simple distinction between unlawful tax evasion and lawful tax avoidance. Tax avoidance means legally reducing your taxable income. Forms of tax avoidance that use tax laws in ways not intended by governments may be considered legal but.

Tax Evasion vs. Tax evasion on the other hand refers to efforts by people businesses trusts and other entities to avoid paying taxes in unlawful ways.

Pandora Papers How The Fight Against Tax Avoidance Is Going Business Economy And Finance News From A German Perspective Dw 06 10 2021

Tax Avoidance And Evasion In Africa Roape

Tax Avoidance Tax Evasion Ppt Download

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Pdf Addressing Tax Evasion Tax Avoidance In Developing Countries Semantic Scholar

Tackle Tax Evasion To Fuel Africa S Development

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Tax Evasion Ppt Download

Tax Evasion Statistics 2022 Update Balancing Everything

Pdf Addressing Tax Evasion Tax Avoidance In Developing Countries Semantic Scholar

Uk By Far The Biggest Enabler Of Global Corporate Tax Dodging Groundbreaking Research Finds The Independent The Independent

Anti Tax Avoidance Measures In China And India Faculty Of Law

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Cross Border Tax Avoidance And Evasion A Developing Asia Perspective International Tax Review

Differences Between Tax Evasion Tax Avoidance And Tax Planning